Community Infrastructure Levy - Draft Charging Schedule (Nov 2014)

Section 3: CIL Rates

(48) 3.1 Southend Borough Council’s CIL rates are as follows:

Table 1: Proposed CIL rates

| Development type | Proposed CIL rate |

|---|---|

| Residential (Class C3 and C4) – Zone 1 (Market areas 1-5) |

|

| Residential (Class C3 and C4) – Zone 2 (Market area 6) |

|

| Residential (Class C3 and C4) – Zone 3 (Market areas 7 and 8) |

|

| Extra care and retirement housing (see below for definition) |

|

| Convenience based supermarkets and superstores and retail warehousing (net retailing space of over 280 square metres) |

|

| Development by a predominantly publicly funded or ‘not for profit’ organisation (see below for definition) including medical and health services, social care, education, emergency services, waste facilities, community facilities, sport and leisure facilities only |

|

| All other uses not cited above |

|

Definition of ‘extra care and retirement housing’: Housing within Class C3 which is purpose built or converted for sale to elderly people with a package of estate management and care services as necessary and which consists of grouped, self-contained accommodation with communal facilities. These premises often have emergency alarm systems and/or wardens. These properties would not provide the same level of care as residential care homes (Class C2) where residents do not live in self-contained accommodation.

Definition of ‘not for profit organisation’: An organisation that does not earn profits for its owners but conducts business for the benefit of the general public; all the money earned by or donated to the organisation is used in pursuing the organisation’s objectives.

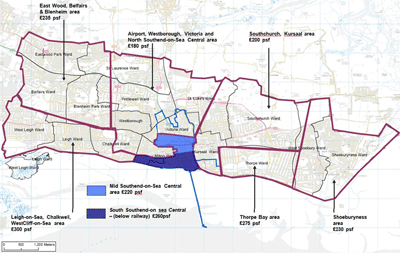

Map of residential charging areas

3.2 The residential charges have been based on zones that reflect the average sales values in the Borough. Figure 1 shows the three zones (separate pdf version of map available on the Council’s website).

Explanation of rates by development type

3.3 Residential: In areas of the Borough where sales values have been found to be lower (including Market Areas 1-5). A nominal CIL rate of £20 per square metre has been chosen (shown as Zone 1 in Figure 1). In the slightly higher value Market Area 6, viability evidence shows that a rate of £30 per square metre can be accommodated (shown as Zone 2 in Figure 1). In the highest value areas of the Borough (including Market Areas 7 and 8), viability evidence shows that a rate of £60 per square metre can be accommodated (shown as Zone 3 in Figure 1).

3.4 Extra care and retirement housing (see Table 1 for definition): Viability evidence has demonstrated that these types of development generate surpluses that can support a CIL charge to varying degrees dependant on the existing use of the site. On this basis, a rate of £20 per square metre across the entire Borough has been chosen.

3.5 Convenience based supermarkets and superstores and retail warehousing (net retailing space of over 280 square metres): Viability evidence has demonstrated that these uses are likely to be viable across the Borough with a maximum CIL rate of £106 per square metre. The 280 square metre threshold is drawn from the Sunday trading laws and is the threshold being used by a number of Charging Authorities. Although the charging schedule includes a split for retail based on the size of unit it does not try to differentiate between in and out of town. Whilst in policy terms a town centre/out-of-town centre split may be desirable, the rules on setting different CIL rates are strict. Because CIL is essentially a tax, Charging Authorities are not allowed to use ‘policy’ based reasons to determine the chosen rates. Where larger schemes do occur in the town centres, they are likely to involve demolition or change of use of existing buildings. CIL is only charged on the net increase in floorspace, therefore many town centre schemes, even if the resultant unit is large, will only include a modest net increase in floorspace. After allowing for a buffer, which is considered to be appropriate to deal with site specific issues, a CIL rate of £70 per square metre has been chosen.

3.6 In respect of all other uses, the viability study looked at offices, industrial and warehousing, other forms of retail (A1-A5) and hotels. It was found that at current levels these uses are unlikely to generate sufficient surpluses to accommodate a significant CIL charge; hence a nominal rate has been chosen. In addition, consideration was given to D1, D2 and sui generis uses but, given the large number of uses that fall within these categories, individual viability testing of the range of possible uses that could come forward has not been undertaken as it would be too complex to test all these uses with any degree of reliability. Therefore, a nominal rate is proposed for all uses that are not mentioned in paragraph 3.3, 3.4 and 3.5 on the basis that such a rate is unlikely to be a significant factor in developers’ decision making and could be absorbed without having a significant impact on viability across the Borough but will contribute to the infrastructure to support the growth. There are some proposed exceptions to the nominal rate applicable to ‘All other uses’ taking into consideration the uses that will be placing a demand on growth associated infrastructure and those that will be providing the infrastructure required to support growth that CIL could possibly be spent on (i.e. as identified in the IDP and Regulation 123 Infrastructure List). Therefore, a zero rate will apply to any community facilities that are predominantly publicly funded or run on a ‘not for profit’ basis, including medical and health services, education, emergency services, community facilities, sport and leisure facilities.

How the chargeable amount will be calculated

(1) 3.7 The precise amount charged for each development will be calculated in accordance with Regulation 40 of the CIL Regulations 2010 (as amended). As stipulated in the Regulations, all charges are based on the gross internal floorspace area. Calculating the chargeable rate will take into account inflation in accordance with the Building Cost Information Service (BCIS) of the Royal Institute of Chartered Surveyors ‘All in Tender Price Index’. Hence, CIL liabilities will reflect the economic cycle to some extent until such time that the charging schedule is reviewed. Appendix 1 provides some examples of how CIL liabilities will be calculated.

(1) 3.8 In addition to the CIL liability, there may also be site specific contributions/provision requirements, including the provision of affordable housing. These will be dealt with through Section 106 planning obligations, Section 278/38 highway agreements or conditions (see consultation document SPD2 Planning Obligations for further details). The viability study that has been carried out in respect of CIL was not only concerned with CIL viability, but also considered the costs of affordable housing (so that delivery of affordable housing in the Borough is not adversely affected by CIL) and made assumptions about other contributions which might be required. Further details can be found in the CIL Overview Report, Viability Study and Addendum Note (available on the Council’s CIL web pages). The rates are therefore considered reasonable, taking into account all financial burdens being placed on development.